Disruptive business models are re-writing the rules of asset management industry, placing continuous pressure on financial institutions to innovate. Fresh thinking is needed to break away from business as usual, to embrace the more rewarding, although more complex alternatives.

Industry leaders are reaching beyond digital enablement to focus on new emerging technologies to better serve their clients. Capital markets, for example, are witnessing the introduction of alternative reference rates and sources of funding for companies, including digital exchanges that deal with crypto-assets.

Tokenization is the new normal in digital world

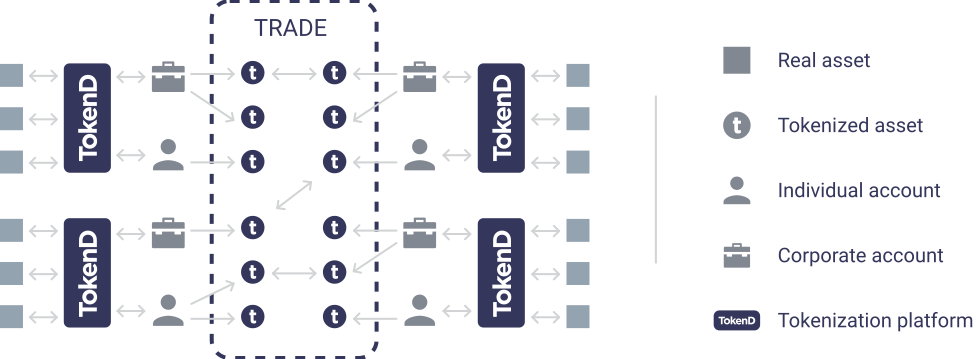

All roads lead to digital. Tokenization is a method that converts rights to an asset into a digital token. That is it. Suppose there is REIT company with thousands of apartments a $200.000 each. Tokenization can transform this apartments into totally arbitraty number of tokens, thus, each token represent a 0.00001% share of underlying asset. Finally, we can issue the token on some sort of a platform supporting smart contracts, for example on Ethereum, so that the tokens can be freely bought and sold on different exchanges or DEX - Decentralized Exchange (currently they have low liquidity) which is a new emerging type of exchange with distributed order book.

Assuming there is a hedge fund which bought 50% of the available tokens which could mean that each token is connected with rental from every apartment. Sounds good? And the transaction could be made in one click (theoretically), the reality is much more complicated but it is the direction where asset’s world will evolve.

All roads lead to digital.

The key is education

Willingness to write source code or even try to understand programming is going to be a new normal for asset managers in digital centry, below you will find list of topics which I am involved in:

assessing value in digital economy

chossing valuable platform

assessing digital project from technical but also from tokenomy point of view

finding emerging markets and trends (like decentralized finance landscape)

secure onboarding in digital world

assesing tokenomy of some project

technical setup of proof of stake (and similar) nodes

落后就要挨打 - If you are backward you will take a beating.

Coffee time

Dear Reader, if you think the article is valuable to you and you want me to drink (and keep writing) high quality coffee (I do like it), feel free to buy me a cup of coffee. ⚡